Opening a French Bank Account: Key Phrases & Vocabulary (B1-B2)

You’ve just arrived in France for work, studies, or long-term stay and desperately need to open a French bank account to receive your salary, pay rent, and handle daily transactions. You’re immediately overwhelmed by France’s notoriously bureaucratic banking system requiring mountains of documentation, bank advisors speaking rapid formal French filled with technical banking terminology you’ve never learned, and confusing account types and service packages with hidden fees. This guide gives you the essential vocabulary, required documents with practical workarounds, phrases for communicating with bank advisors, and cultural knowledge to successfully open and manage your French bank account without frustrating repeat visits or expensive mistakes.

Why opening a French bank account feels impossibly bureaucratic

French banking operates under strict anti-money laundering regulations, creating a documentation-heavy process that frustrates foreigners accustomed to simpler banking systems. What takes 15 minutes online in the US or UK requires multiple in-person appointments with extensive paperwork in France.

🇺🇸 Opening a bank account in France requires lots of patience and documents

Roger experienced this challenge firsthand when he moved to France in 2012 and needed to navigate the French banking system without fully understanding the terminology or cultural expectations. The process was so challenging that he now includes practical banking French in his private lessons because textbooks teach grammar but ignore real-world administrative vocabulary foreigners desperately need.

Essential documents required – and how to say them in French

Required documents for opening a French bank account

French banks require specific documents before opening any account. Prepare these BEFORE your bank appointment to avoid frustrating repeat visits.

🇺🇸 Valid ID document (passport, national ID card, driver’s license)

🇺🇸 Proof of address less than 3 months old (utility bill, internet bill, tax notice)

🇺🇸 Residence permit (for non-EU citizens – carte de séjour, visa long séjour)

🇺🇸 Proof of income or professional activity (work contract, pay stubs, student enrollment)

🇺🇸 School enrollment certificate (for students)

🇺🇸 Initial deposit (amount varies by bank, often 10-50€ minimum)

⚠️ The proof of address catch-22

This frustrates every foreigner: you need a French address to open a bank account, but many landlords require a French bank account to rent an apartment. How do you break this cycle?

Solutions that work:

- Temporary accommodation receipt: Hotel bill, Airbnb confirmation, or hostel receipt showing French address (some banks accept this)

- Attestation d’hébergement: If staying with French friends/family, they can write a letter attesting you live with them + copy of their utility bill + copy of their ID

- Work address: Some banks accept your employer’s address as proof of domicile

- Online banks: French online banks (Boursorama, N26, Revolut) have less strict address requirements

Roger helps students navigate these practical administrative challenges in his lessons because understanding the system dramatically reduces frustration.

Types of French bank accounts

Basic account types and vocabulary

🇺🇸 Current account / Checking account (for daily transactions, salary, payments)

🇺🇸 Savings account (earns interest, limited withdrawals)

🇺🇸 Tax-free savings account (specific French product, 3% interest tax-free, max 22,950€)

🇺🇸 Joint account (shared account with spouse/partner)

🇺🇸 Business account (for self-employed/business owners)

🇺🇸 Youth account (for people under 25-30, often with reduced fees)

What most foreigners need: A basic “compte courant” (current account) for receiving salary, paying bills, and daily transactions. You can add a “Livret A” savings account later once established.

Making an appointment and communicating with your bank advisor

Essential phrases for scheduling and initial conversation

🇺🇸 I would like to make an appointment to open a bank account

🇺🇸 What documents are required to open an account?

🇺🇸 I just arrived in France and need an account to receive my salary

🇺🇸 I’m a foreign student and I’m looking for a youth account

🇺🇸 What are the account maintenance fees?

🇺🇸 Is there a minimum deposit required?

🇺🇸 How long does it take to activate the account?

🇺🇸 When will I receive my bank card?

Essential French banking vocabulary you’ll use constantly

Account and core banking services

🇺🇸 Account holder

🇺🇸 Account number

🇺🇸 Bank details document (IBAN, BIC/SWIFT, bank address – essential!)

🇺🇸 IBAN – international account number format

🇺🇸 BIC/SWIFT code (bank identification for international transfers)

🇺🇸 PIN code (for your bank card)

🇺🇸 Authorized overdraft (amount you can go negative)

🇺🇸 Overdraft fees/interest charges

Cards and payment methods

🇺🇸 Bank card / Debit card (“Carte Bleue” is old brand name still used)

🇺🇸 Debit card (immediate deduction from account)

🇺🇸 Credit card (monthly payment, not immediate)

🇺🇸 Immediate debit card (most common in France)

🇺🇸 Deferred debit card (charged at end of month)

🇺🇸 Contactless payment (tap to pay)

🇺🇸 Checkbook (still widely used in France!)

🇺🇸 To block/cancel a card (when lost or stolen)

💡 The all-important RIB explained

The RIB (Relevé d’Identité Bancaire) is THE most important French banking document. You’ll need it constantly for:

- Receiving your salary (employer needs your RIB)

- Setting up direct debits for rent, utilities, phone

- Receiving money transfers

- Government benefits (CAF housing aid, etc.)

- Pretty much any financial transaction in France

🇺🇸 Can you provide me with a RIB please?

Always carry 2-3 RIB copies with you – French administration constantly asks for them! You can get printed copies from your bank OR download PDF versions from your online banking portal.

Banking operations and transactions vocabulary

Making and receiving payments

🇺🇸 To make a transfer (YOU send money – one-time action YOU initiate)

🇺🇸 One-time transfer

🇺🇸 Standing order / Recurring transfer (automatic regular transfer you set up)

🇺🇸 To receive a transfer

🇺🇸 Direct debit (THEY automatically take money from your account – you authorize)

🇺🇸 To set up a direct debit

🇺🇸 To cancel a direct debit

🇺🇸 To deposit money / a check

🇺🇸 To withdraw money

🇺🇸 ATM (Distributeur Automatique de Billets)

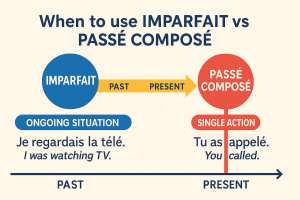

⚠️ Critical distinction: Virement vs Prélèvement automatique

English speakers constantly confuse these because English uses “automatic payment” for both concepts, but French distinguishes clearly:

Virement (transfer):

- YOU initiate the payment

- YOU control when and how much

- YOU send money to someone else’s account

- One-time OR recurring (if you set up recurring transfers)

🇺🇸 I make a 500€ transfer to my landlord each month (YOU send it)

Prélèvement automatique (direct debit):

- THEY take money from your account

- You authorize them once, then it’s automatic

- Amount can vary (like utility bills)

- Common for: rent, utilities, phone, internet, subscriptions

🇺🇸 My rent is automatically debited on the 5th each month (THEY take it)

Mixing these up causes confusion when setting up payments with your landlord or utility companies!

Checking your account and understanding statements

Account monitoring vocabulary

🇺🇸 Bank statement / Account statement

🇺🇸 To check my account online

🇺🇸 Account balance

🇺🇸 Debit / Money leaving your account (expense)

🇺🇸 Credit / Money entering your account (income)

🇺🇸 A transaction / An operation

🇺🇸 Transaction description / Label

🇺🇸 To be overdrawn / In overdraft (negative balance)

🇺🇸 Unauthorized / fraudulent transaction

🇺🇸 To dispute a transaction

Understanding French banking fees

Common banking fees vocabulary

French banks charge more fees than US/UK banks in many cases. Understanding these upfront avoids unpleasant surprises.

🇺🇸 Account maintenance fees (monthly/annual fee for having the account – often 2-5€/month)

🇺🇸 Bank card fees (annual fee for your debit/credit card – often 40-50€/year)

🇺🇸 Transfer fees (especially international transfers)

🇺🇸 Foreign ATM withdrawal fees

🇺🇸 Overdraft fees (expensive in France – avoid going negative!)

🇺🇸 Currency exchange commission

🇺🇸 Bounced check / Failed direct debit fees

Typical costs for basic French bank account:

- Account maintenance: 0-5€/month

- Debit card: 40-50€/year (divided monthly)

- Total: ~5-10€/month for basic services

Some French banks offer “gratuité” (free) accounts for students, young people, or if you maintain minimum balance. Always ask!

⚠️ Online banks vs traditional banks

France has excellent online-only banks (Boursorama, Fortuneo, N26, Revolut) that offer:

- Zero or very low fees

- No account maintenance fees

- Free bank cards

- Better foreign exchange rates

- Mobile apps in multiple languages

Downsides:

- No physical branches (all online/phone support)

- Some French institutions/landlords prefer traditional banks

- Opening account can be harder without French address

Many foreigners use both: traditional bank for main account + online bank for everyday use and travel.

Online banking and mobile app vocabulary

Navigating French banking apps

🇺🇸 Mobile banking app

🇺🇸 To log into your customer area

🇺🇸 Username / Login ID

🇺🇸 Password

🇺🇸 Strong authentication / Two-factor authentication

🇺🇸 To validate a transaction by SMS code

🇺🇸 To download a RIB (bank details document)

🇺🇸 To check transaction history

🇺🇸 To make an online transfer

🇺🇸 To add a beneficiary / payee (person you transfer money to)

🇺🇸 To activate/deactivate contactless payment

🇺🇸 To block/cancel the card (if lost or stolen)

💡 Roger’s practical tips for French banking success

Roger learned French banking through direct experience after moving to France in 2012. In his French lessons, he teaches practical strategies that textbooks ignore:

- Always carry your RIB: You’ll need it constantly for French bureaucracy

- Set up online banking immediately: Makes everything easier than branch visits

- Understand “virement” vs “prélèvement”: Critical for setting up rent/utilities correctly

- Ask about student/young person discounts: Can save 100-200€/year on fees

- Keep emergency numbers: Card opposition number (+33 892 705 705 for Visa, varies by bank)

- Monitor your account weekly: French banks less protective than US banks about fraud

Most importantly: don’t be intimidated by French banking vocabulary! Once you understand the key terms, the system becomes straightforward. Roger’s trilingual background and adult-learner experience help him explain not just the vocabulary but the cultural context native speakers take for granted.

Study glossary – Essential banking terms

| French Term | English Translation | Usage Example |

|---|---|---|

| Un compte courant | Current/checking account | Ouvrir un compte courant |

| Un RIB | Bank details document | Fournir un RIB à l’employeur |

| Une carte bancaire | Bank/debit card | Payer avec une carte bancaire |

| Un virement | Transfer (you initiate) | Faire un virement de 500€ |

| Un prélèvement automatique | Direct debit (automatic) | Mettre en place un prélèvement |

| Le solde | Balance | Vérifier le solde du compte |

| Être à découvert | To be overdrawn | Éviter d’être à découvert |

| Les frais bancaires | Banking fees | Payer des frais bancaires |

| Un justificatif de domicile | Proof of address | Fournir un justificatif |

| Faire opposition | To block/cancel card | Faire opposition en cas de vol |

| Un relevé de compte | Bank statement | Télécharger un relevé |

| Un chéquier | Checkbook | Demander un chéquier |

Master practical French for banking with Roger

Opening and managing a French bank account requires more than vocabulary – you need confidence communicating with bank advisors in formal French, understanding French banking culture and bureaucracy, and navigating systems designed for native speakers.

🇺🇸 Understanding the French banking system makes life in France much easier

Roger includes practical administrative French like banking vocabulary in his lessons because he remembers struggling with these exact challenges when he moved to France. His trilingual background (English/German/French) and adult-learner experience help him explain not just the vocabulary but the cultural context that textbooks miss.

In his private French lessons, Roger teaches:

- How to prepare for bank appointments with proper formal French

- What documents to gather and how to explain your situation

- Understanding banking letters and contracts (French administrative language)

- Navigating French banking apps and online systems

- Cultural expectations around banking in France vs Anglo-American countries

The €9 trial lesson lets you experience this practical, real-world approach to French that helps you handle actual administrative tasks, not just pass textbook exercises. Roger’s approach focuses on giving you the confidence and vocabulary to navigate real French systems successfully.